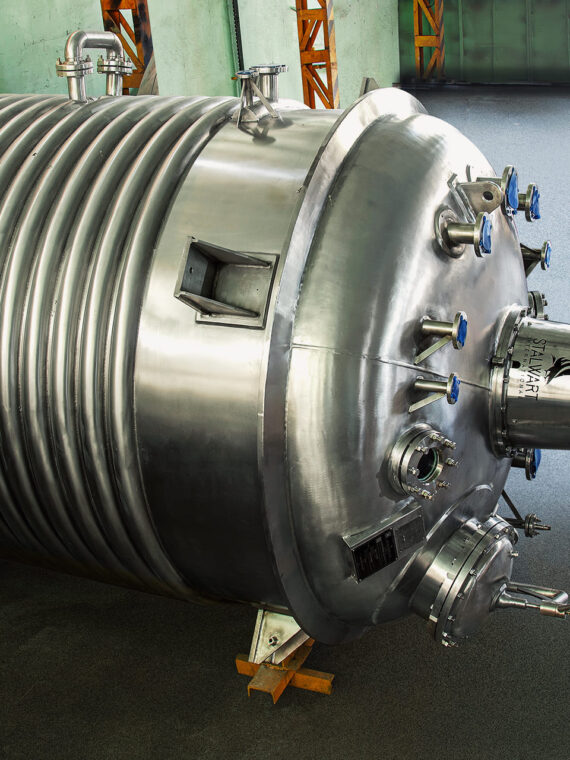

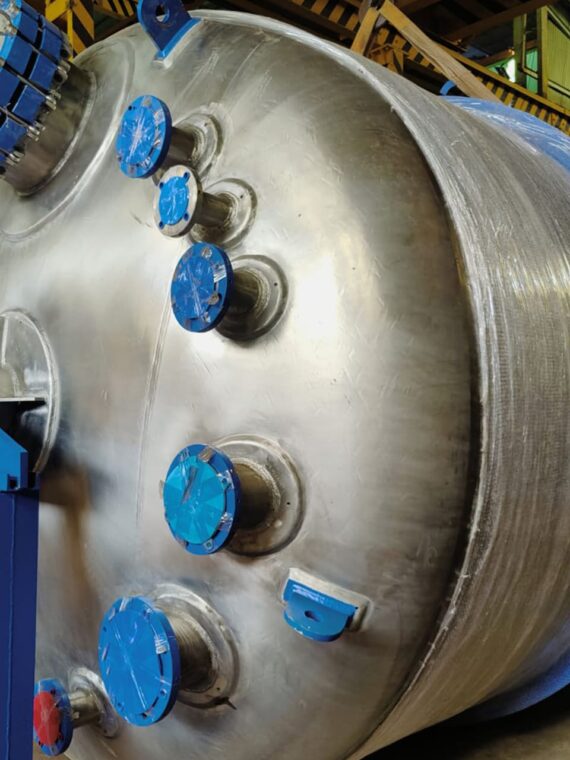

Pressure vessels are a critical component in industries such as oil and gas, petrochemicals, power generation, and water treatment. Designed to store and handle gases or liquids under pressure, they require advanced engineering, precision fabrication, and strict compliance with international safety standards.

Saudi Arabia, traditionally recognized as one of the largest producers and exporters of oil, is rapidly evolving into a manufacturing hub. With its ambitious Vision 2030 program, the Kingdom is diversifying its economy and investing heavily in industrial infrastructure. This shift is driving a new wave of opportunities in specialized manufacturing, with pressure vessel production emerging as a strategic focus area.

Saudi Arabia’s Strategic Vision and Policy Support

Saudi Arabia’s industrial transformation is anchored in Vision 2030, the national roadmap to diversify the economy beyond oil dependency. Manufacturing and heavy industries, including pressure vessel production, are central to this strategy.

Vision 2030 and Industrial Diversification

The Kingdom aims to position itself as a global hub for advanced manufacturing by investing in technology, infrastructure, and localized production. Pressure vessels, widely used in oil, gas, and chemical projects, align directly with these objectives.

Government Incentives and Free Zones

Saudi Arabia offers tax incentives, streamlined regulations, and industrial free zones such as the Jubail and Yanbu Industrial Cities. These zones provide access to utilities, logistics, and integrated supply chains, creating a favorable environment for pressure vessel manufacturers.

Regulatory Reforms

The government has simplified procedures for foreign investments and joint ventures. Policies encouraging local content (IKTVA – In-Kingdom Total Value Add program) are pushing industries to source and manufacture domestically, accelerating growth in pressure vessel fabrication.

According to the Saudi Vision 2030 official plan, the Kingdom is targeting a substantial increase in industrial sector contribution to GDP through localization and technology-driven manufacturing

You May Also Like: Indian Process Equipment Manufacturers Driving Saudi arabia Petrochemical Vision 2030

Demand Drivers Fueling Pressure Vessel Manufacturing

Saudi Arabia’s demand for pressure vessels is expanding rapidly, supported by its strong energy and industrial base. Several key drivers contribute to this growth.

Oil, Gas, and Petrochemical Expansion

As one of the world’s largest oil producers, Saudi Arabia continues to invest in refining, petrochemical plants, and storage facilities. Pressure vessels are essential for handling hydrocarbons, processing chemicals, and ensuring safe operations in these sectors.

Water Treatment and Desalination Projects

The Kingdom relies heavily on desalination to meet its freshwater needs. Pressure vessels are used in reverse osmosis systems and water treatment plants, creating consistent demand in this critical sector.

Power Generation and Industrial Growth

Ongoing investments in conventional and renewable power generation require pressure vessels for boilers, heat exchangers, and steam systems. Industrial expansion in cement, fertilizers, and metallurgy further boosts local demand.

Infrastructure and Supply Chain Strengths

Saudi Arabia’s industrial ecosystem provides the foundation needed for large-scale pressure vessel manufacturing.

Ports and Logistics

The Kingdom’s ports, including King Abdullah Port and Jeddah Islamic Port, are among the busiest in the region. Efficient logistics and connectivity to international markets enable manufacturers to export pressure vessels competitively.

Availability of Raw Materials

Local access to steel and other essential raw materials supports cost-effective production. With Saudi Arabia expanding its steel and metallurgical capacity, manufacturers benefit from reduced reliance on imports.

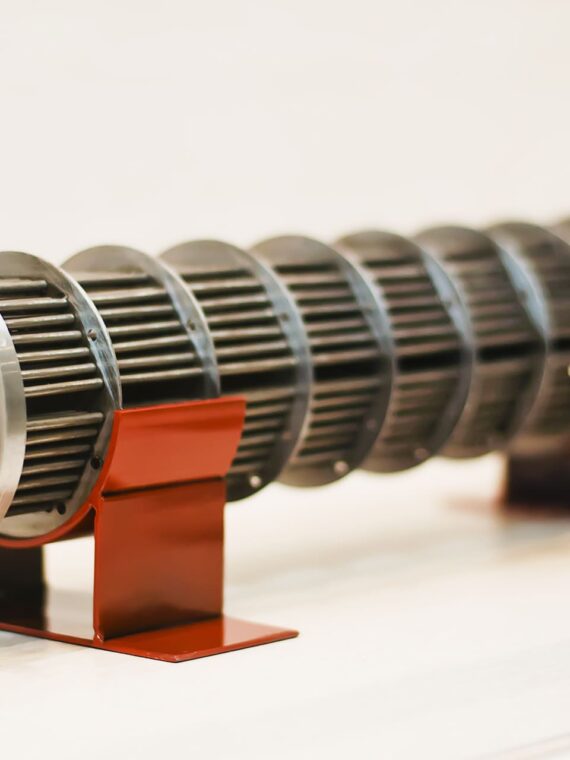

Advanced Fabrication Facilities

Industrial zones such as Jubail and Yanbu host fabrication yards equipped with heavy lifting, automated welding, and non-destructive testing (NDT) facilities. These capabilities allow the production of large and complex pressure vessels while maintaining international quality standards.

Skilled Workforce and Technological Capability

The growth of pressure vessel manufacturing in Saudi Arabia is strongly supported by investments in human capital and advanced technology.

Workforce Development

The Kingdom has launched vocational training programs and technical institutes focused on welding, fabrication, and mechanical engineering. These initiatives ensure a steady pipeline of skilled professionals capable of handling complex manufacturing tasks.

Adoption of Advanced Techniques

Saudi manufacturers are increasingly using automated welding, CNC machining, and robotics to enhance precision and reduce production time. Non-destructive testing (NDT) methods are also widely applied to guarantee safety and compliance.

International Collaboration

Partnerships with global engineering firms and technology providers have accelerated the transfer of knowledge. This collaboration has raised the standards of local manufacturing to match international benchmarks, making Saudi-made pressure vessels globally competitive.

Quality & Standards: Meeting Global Requirements

Certifications (ASME, PED, ISO)

Saudi factories producing pressure vessels typically hold ASME U-Stamp, PED/EN13445, and ISO 9001/14001/45001 certifications. These align local manufacturing with global safety and quality norms and enable exports to Europe, North America, and Asia.

Inspection & Safety Protocols

Strict material traceability, non-destructive testing (NDT), and hydrostatic tests ensure vessel integrity. Independent audits and third-party inspections verify compliance with ASME/PED and customer specifications.

Traceability & Documentation

Each step — from raw material purchase to final testing — is fully documented. Digital tracking systems, material certificates, and inspection reports provide transparent proof of compliance for regulators and buyers.

Competitive Advantages Over Regional and Global Players

Lower Logistics and Tariff Costs

Saudi Arabia’s location at the crossroads of Europe, Asia, and Africa cuts shipping times and costs. Free trade zones and favorable tariffs further reduce export expenses for heavy equipment.

Lower Labor & Energy Costs

Abundant energy (fuel, electricity) and relatively lower labor costs give Saudi manufacturers a competitive cost structure versus many global peers.

Access to Large Energy Supplies

Stable access to oil, gas, and power supports uninterrupted production and high-capacity operations, enabling large-scale fabrication at predictable costs.

Challenges and Mitigation Strategies

Regulatory or Environmental Hurdles

Compliance with Saudi and international environmental rules can be complex. Companies mitigate this through early regulatory engagement, ISO 14001 systems, and third-party audits.

Skill Gaps & Retaining Talent

Specialized welding, NDT, and design skills are in short supply. Manufacturers address this via in-house training programs, partnerships with technical institutes, and competitive retention packages.

Supply Chain Reliability & Raw Material Quality

Fluctuations in global steel and alloy supply affect timelines. Firms counter this with diversified suppliers, local sourcing where possible, and strict incoming material inspections.

Future Outlook & Growth Opportunities

Emerging Markets for Pressure Vessels

Demand is rising in renewable energy, hydrogen production, and CO₂ capture sectors. Saudi manufacturers can diversify into these high-growth industries to increase export share.

Technology Trends

Digital twins, modular fabrication, and smart monitoring systems are improving quality control and reducing downtime, giving early adopters a market edge.

Export Growth & Partnerships

Strategic partnerships with global EPCs (Engineering, Procurement & Construction firms) and joint ventures expand Saudi factories’ international reach and credibility.

You May Also Like: India–Saudi Arabia Industrial Collaboration for Growing Market

Conclusion

Saudi Arabia combines certified manufacturing standards, cost advantages, and strategic location to position itself as a global hub for pressure vessel manufacturers. By adopting advanced technologies and targeting emerging markets, Saudi manufacturers can expand exports and attract international partnerships. For global buyers, this means reliable quality, competitive pricing, and reduced lead times.

FAQs

1. Why is Saudi Arabia becoming a major hub for pressure vessel manufacturing?

Saudi Arabia’s rapid industrialization under Vision 2030 is driving demand for oil, gas, petrochemical, and renewable energy infrastructure. This has created a strong local market for pressure vessels, supported by government incentives, modern industrial zones, and partnerships with global engineering firms.

2. Which industries in Saudi Arabia need pressure vessels the most?

Oil & gas, petrochemicals, desalination plants, and renewable energy projects are the largest users of pressure vessels. The Kingdom’s ongoing diversification—especially in hydrogen, ammonia, and water treatment—further boosts demand.

3. How does ecommerce migration relate to Saudi Arabia’s manufacturing growth?

As industries digitize, ecommerce migration (shifting procurement and sales to online platforms) is enabling Saudi manufacturers to access international suppliers, streamline logistics, and adopt Industry 4.0 practices—making production faster and more competitive.

4. What makes Saudi Arabia attractive to global pressure vessel manufacturers?

Key factors include low-cost energy, proximity to large markets in the Middle East and Africa, specialized free zones like Jubail Industrial City, and government-backed localization programs encouraging high-value manufacturing inside the Kingdom.

5. What role does Vision 2030 play in pressure vessel manufacturing growth?

Vision 2030 prioritizes industrial diversification, local production, and export-led growth. Pressure vessel manufacturing fits this strategy by reducing import reliance and creating high-skilled jobs in engineering and fabrication.

6. Is Saudi Arabia focusing on sustainability in pressure vessel manufacturing?

Yes. Saudi companies are increasingly adopting advanced materials, automated welding, and digital inspection tools to meet global safety, quality, and environmental standards—supporting both green energy projects and circular economy goals.