Saudi Arabia’s drive to expand its petrochemical capacity, part of a broader downstream strategy tied to its long-term development plan, Vision 2030, has created fresh demand for high-quality process equipment, including pressure vessels, receivers, and gas/liquid separators that sit at the heart of refining and chemical plants. Indian engineering manufacturers have quietly become an essential part of that supply chain. Here’s how they’re stepping up to meet Saudi petrochemical demand: on price, compliance, and capability.

Rising Demand And Opportunity

The petrochemical market in the Kingdom keeps on expanding, with the state and private majors investing heavily in new crackers, aromatics units, and integrated refining-petrochemical complexes. Market analyses note steady growth in the Saudi petrochemicals market with larger regional momentum across the Middle East on the back of continued upstream integration and projects for the conversion of crude into higher-value petrochemicals. This is leading to an increase in demand for such engineered equipment as separators and receivers used in feedstock conditioning, gas processing, and product recovery.

Advantage Against Competition: Low Price + Technical Expertise

Indian manufacturers can provide a beautiful combination of affordable prices and developed engineering. Over two decades, many foundries and fabrication houses in India have scaled up from simple vessels to complex ASME-coded pressure equipment and purpose-designed separators. This is because separators are not generic; they are engineered against specific feedstock properties, flow regimes, temperature-pressure profiles, and downstream process requirements. Indian firms combine lower manufacturing overheads with an expanding talent pool of process and mechanical engineers to supply tailored designs at attractive landed costs for overseas buyers. Indian suppliers positioning themselves for export include specialist fabricators and process equipment houses that list receivers and separators as standard product lines.

Meeting Strict Quality And Standards Requirements

Supplying central Saudi projects, especially those tied to Saudi Aramco or large refinery-petchems alliances, requires more than low cost: it demands international quality stamps and traceable QA systems. Saudi Aramco and other operators require vendors to comply with ASME BPVC codes, possess ASME “U” or higher stamps for pressure vessels, and meet specific material and inspection standards outlined in their vendor qualification documents. Indian manufacturers have responded by pursuing these exacting certifications, gaining ASME stamps, ISO registrations, and third-party inspection relationships, enabling them to be technically qualified on large bids. News of Indian firms achieving ASME U certification underlines this trend.

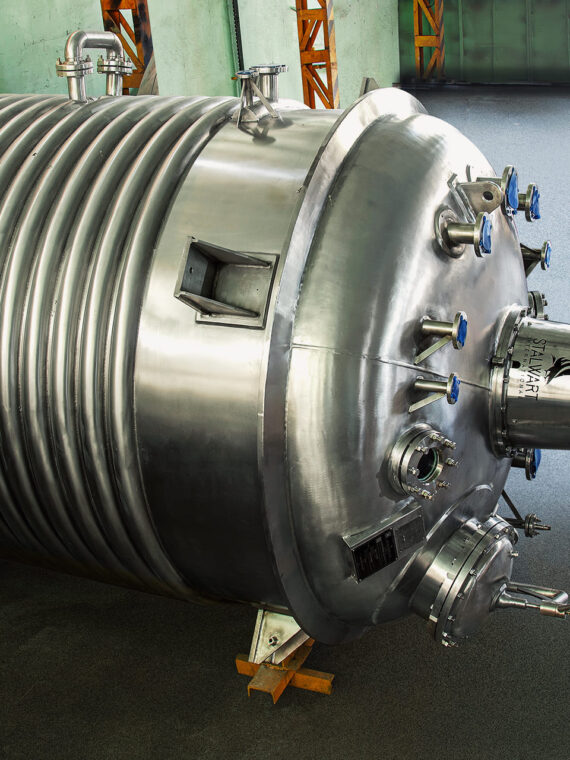

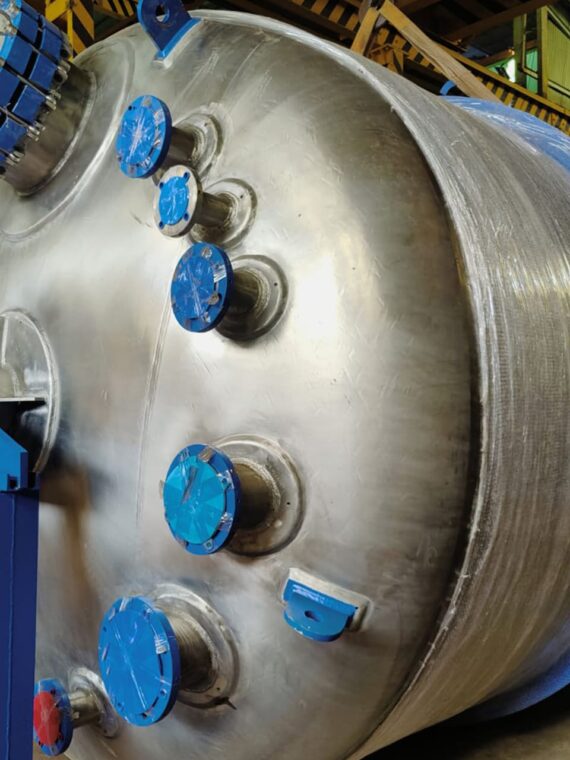

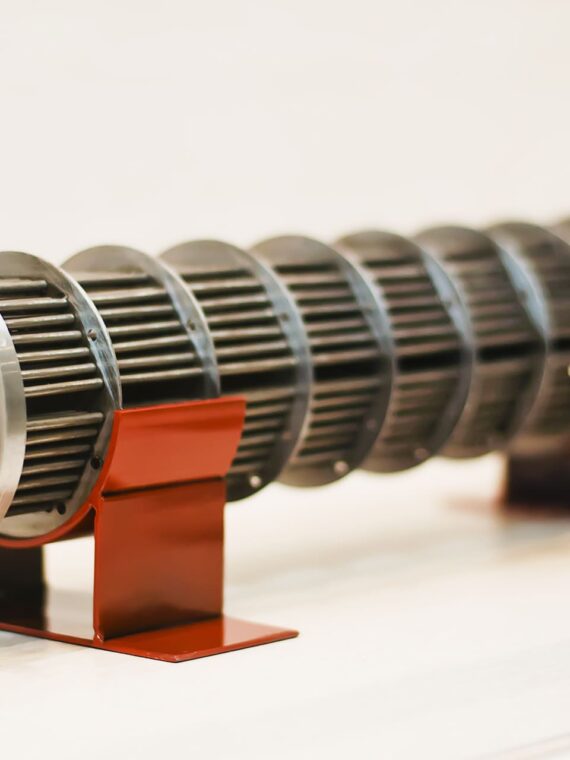

Customisation, Rapid Prototyping, and Shop Capabilities

Petrochemical separators are often custom-designed: two-phase versus three-phase separation, mist eliminators, coalescing internals, inlet cyclonics, and demisting pads, each fine-tuned for an application. Indian workshops have invested in larger bays, CNC plate cutting, automatic welding, and test rigs for hydrostatic and pneumatic testing. Several manufacturers now boast delivery with complete documentation packages, material traceability, welding records, and NDT reports on vapour-liquid separators, air receivers, and high-pressure vessels, as would be expected by Gulf clients. This readiness of shops cuts lead times for custom orders and reduces the need for expensive on-site modifications.

Export Readiness: Documentation, Inspection, and After-Sales

Success in Saudi project work often depends on paperwork as much as metal: certified mill test reports, NDT records, ASME stamps, FAT protocols, and approved inspection plans. Indian suppliers have built processes to produce turnkey documentation packs and to host third-party inspections from internationally recognised bodies. Many also provide after-sales services-spare internals, refurbishment kits, and technical support-essential for long lifecycle plants. These commercial practices reduce perceived risk for Saudi buyers and, in some cases, allow Indian firms to partner with local EPCs to meet localisation and logistics requirements.

Strategic Partnerships and Localization

Large Saudi projects favour vendors who can align with local procurement rules, Saudi Aramco supplier codes, and in-kingdom participation targets. This is being addressed by Indian companies that are increasingly forming partnerships with Gulf distributors, setting up regional offices, or working through EPC partners in order to meet the requirements of registration and on-site support. Simultaneously, the quality of exports and documentation of processes in the Indian manufacturing sector is assisting in overcoming cultural and business distance problems, which will make Indian suppliers credible partners in long-term downstream development in the Kingdom.

The Dilemmas And The Solution

There are still challenges: there are Saudi tenders that give preference to local manufacturing presence vendors or pre-qualified vendors on the mega EPC lists. Logistics, currency fluctuations, and the changing local content regulations also complicate bid economics. Nevertheless, with further development of the plant capacities, additional international accreditations (ASME U/U2, National Board registrations), and an expansion of project management/documentation processes, Indian separator and receiver producers have a great chance to receive increasing volumes caused by the Saudi petrochemical growth. Recent major downstream announcements and joint ventures in the Kingdom signal sustained project pipelines where well-qualified Indian fabricators can play a meaningful role.

You May Also Like: Indian Process Equipment Manufacturers Driving Saudi Arabia’s Petrochemical Vision 2030

Conclusion

Saudi Arabia’s petrochemical push is structural and long-term. Indian receiver and separator manufacturers have increasingly been able to meet the Kingdom’s technical and commercial requirements through a mix of competitive pricing, improved shop capabilities, targeted certifications, and export-focused documentation and service models. For Saudi buyers looking for value without compromising code compliance, Indian suppliers are no longer just a low-cost option; they’re becoming strategic, standards-driven partners in the petrochemical value chain.

FAQs

1. Why is Saudi Arabia increasing its demand for receivers and separators?

Saudi Arabia is rapidly expanding its petrochemical and downstream processing capacity under the Vision 2030 program. New refinery and chemical plant projects require high-performance pressure vessels, receivers, and gas–liquid separators to support continuous and safe processing, which is driving the demand.

2. Why do Saudi EPC companies prefer sourcing receivers/separators from India?

Indian suppliers provide certified petrochemical-grade equipment at competitive pricing, shorter delivery timelines, and full documentation support for SABIC, Aramco, and Royal Commission approvals, making them a dependable supply partner for EPC contractors.

3. Which materials are commonly used for receivers and separators supplied to the Saudi market?

The most common materials include carbon steel, SA 516 Grade 70, stainless steel (SS 304/316), duplex stainless steel, and corrosion-resistant alloys, depending on operating pressure, temperature, and media handled in Saudi petrochemical units.

4. What industries in Saudi Arabia use Indian receivers and separators the most?

The main users include petrochemical complexes, gas processing plants, refineries, desalination facilities, and chemical manufacturing units under companies such as Saudi Aramco, SABIC, Ma’aden, and EPC contractors developing mega projects.

5. Do Indian manufacturers provide documentation and certification support required in Saudi Arabia?

Yes. They supply full technical documentation including WPS/PQR, MTC, NDT reports, hydrotest certificates, and compliance documents for Aramco, SABIC, and ISO/ASME approvals to ensure quick vendor approval and regulatory clearance.