Over the last decade, the Netherlands has quietly established a position for itself as one of Europe’s most attractive gateways for advanced chemical process equipment, from chemical reactors and heat exchangers to skid-mounted systems and precision pumps. That shift is not accidental; it’s the product of a tightly woven combination of world-class logistics, deep industrial clusters, business-friendly fiscal and R&D incentives, and strategic geography, together making the country uniquely convenient for companies moving high-value, complex equipment into and across Europe.

World-class port and logistics infrastructure

The backbone of the Netherlands’ advantage is the port of Rotterdam, Europe’s largest seaport, along with a well-integrated inland waterway, rail, and road network that allows for efficient forward distribution to Germany, Belgium, and the wider EU. Where the oversized or sensitive process equipment has to be treated with care, Rotterdam’s terminals, heavy-lift capabilities, and industrial hinterland are equipped to handle such cargo. This logistical strength is the main reason why international buyers and OEMs route imports of process equipment via Dutch ports.

Fast, efficient customs and EU access

Importing through the Netherlands often simplifies trade into the single market. The Dutch customs operations at major ports operate 24/7 and are set up to clear complex consignments quickly, a practical boon for expensive machinery where delay equals cost. Once goods are released in the Netherlands, they can move freely through EU member states, which encourages firms to use Dutch entry points as their European distribution hub.

Chemical clusters and local knowledge

Beyond logistics, the Netherlands has concentrated chemical and process-industry ecosystems, of which the Brightlands Chemelot Campus and the large petrochemical and process-industry cluster around Rotterdam are the most well-known. These clusters bring together in a single geographic triangle manufacturers, engineering houses, testing labs, and specialist service providers in areas such as installation, commissioning, supply, and maintenance of spare parts, reducing the technical and commercial risk of importing complex process equipment. When a buyer needs local integration expertise or swift spares, the ecosystem is there.

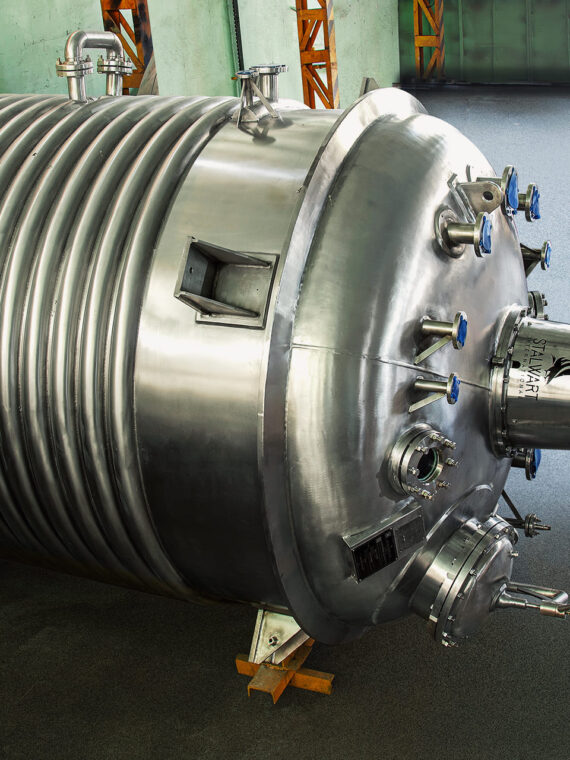

Domestic suppliers and engineering partners

There is a common misconception that routing equipment through the Netherlands implies foreign vendors are dependent on it exclusively for support. In reality, numerous specialized manufacturers and engineering firms located in the country can handle the production and servicing of pumps, heat exchangers, skids, and reactors, providing an extra layer of support by co-engineering, testing, and modifying imported units according to European standards or for a particular process plant. That extra layer of local supply and service cuts lead times and reduces integration risks for end-users.

Attractive fiscal and innovation incentives

The Dutch government actively encourages high-value manufacturing and process innovation. R&D tax credits, like the WBSO scheme, reduce the cost of development and process optimization, making the Netherlands appealing for imports, R&D, pilot plants, and retrofits tied to those imports. Besides that, pragmatic VAT and customs arrangements can facilitate cash flow at import time for companies operating across borders. Those measures combine to lower the effective cost of establishing European operations through the Netherlands.

Sustainability & energy transition alignment

Large Dutch industrial clusters are heavily investing in decarbonization, hydrogen infrastructure, and circular chemistry. For companies importing next-generation process equipment, say, hydrogen-ready reactors, electrochemical skids, and solvent-recovery units, proximity to testbeds, hydrogen pipelines, and shared utilities is a key competitive advantage, as it will make pilot installs and scale-ups more feasible and more attractive. Initiatives like those at Chemelot and the Rotterdam cluster actively foster collaboration on clean process technologies.

Risk mitigation and resilience

Similarly, the focus of logistics and supplier networks supports supply chain resilience. If a component fails or a last-minute modification is required before commissioning, there are local engineering workshops and specialist fabricators that can intervene. That proximity reduces the downtime risk that often accompanies long-distance, single-source imports—a compelling operational reason companies choose the Netherlands as their entry point in Europe.

Practical implications for buyers and suppliers

If you are a chemical process equipment manufacturer considering Europe, the Netherlands offers:

- faster customs clearance and 24/7 port services for complex lifts

- easy distribution into Europe’s largest industrial markets: Germany, Benelux, and the Nordics.

- access to engineering partners, testing labs, and service providers for local compliance and commissioning.

- fiscal incentives for R&D and operations that lower life cycle costs.

You May Also Like: Receiver/Separator & cGMP Equipment Solutions for the Netherlands

Bottom line

But the Netherlands is more than just a convenient transit point; it’s an operational hub that melds logistics, industrial know-how, and policy incentives together into one package that cuts cost, risk, and time-to-commission for advanced chemical process equipment. For OEMs, integrators, and end users targeting Europe, routing equipment through Dutch ports and leveraging local partners and policy tools is an emerging best practice that can turn import complexity into commercial advantage.

FAQs

1. Why is the Netherlands a key market for importing chemical process equipment?

Because it offers strong chemical clusters, fast logistics, and easy EU access through Rotterdam and Schiphol.

2. Why do Dutch industries import advanced reactors and heat exchangers?

To upgrade plant efficiency, meet EU safety standards, and support continuous modernization.

3. Why is the Netherlands a good entry point for Indian equipment manufacturers?

Because Dutch regulations are clear, CE/PED compliance is accepted, and it provides quick access to nearby EU markets.

4. How do sustainability targets affect equipment imports in the Netherlands?

Industries import energy-efficient and low-emission equipment to meet EU Green Deal and national carbon-reduction goals.

5. What future projects will increase equipment demand in the Netherlands?

Hydrogen, biochemicals, recycling, pharma, and specialty chemical expansions will drive higher imports.