The FMCG market in the Netherlands is changing rapidly due to shifting consumer preferences, stricter food safety controls, sustainability targets, and shorter time-to-market. The Netherlands is one of the most developed food-producing countries in Europe and has established itself as a center of high-quality food exports. The key enabler in the centre of this evolution is the critical industrial food processing machinery.

Modern food processing equipment in the Netherlands has redefined production, scaling, and competition for FMCG companies in the global arena, across the dairy and beverage industries, ready-to-eat meals, snacks, and plant-based foods.

The Netherlands: A Benchmark Market for the FMCG Sector

This country has a combination of infrastructure, regulation, and innovation in the Dutch FMCG ecosystem. Unilever, Friesland Campina, and Heineken are among the global competitors with highly developed production facilities in the country that cater to both the European and international markets.

The Netherlands has emerged as a strategic base for FMCG production, thanks to strong logistics support from the Port of Rotterdam. The continuation of this leadership, however, is more toward acquiring next-generation food processing equipment that the Netherlands’ manufacturers rely on for speed, hygiene, and compliance.

Why Equipment Innovation Matters in the FMCG Sector

Low margins, high volumes, and stiff competition characterise the FMCG industry. The suppliers are responsible for maintaining a similar level of quality and for responding promptly to varying customer preferences. Conventional manufacturing arrangements can no longer do.

The modern industrial food processing machineries allow:

- Faster production cycles

- Higher product consistency

- Less waste and less use of energy.

- Uninterrupted regulatory compliance.

Therefore, equipment investment ceases to be operational; it becomes strategic.

Key Equipment Trends Shaping the Future of Food Manufacturing

1. Smart Manufacturing & Automation

One of the strongest trends that is transforming the FMCG industry is automation. The Dutch food producers are switching towards:

- Automated batching and mixing.

- Robotic palletizing and case packing.

- Production lines under the control of PLCs and SCADA.

Minimized downtime, improved yield, and repeatable batches are among the benefits that innovative equipment with sensors and real-time monitoring can deliver to manufacturers. Asset longevity relies on data-driven predictive maintenance to avoid surprises and enhance asset life.

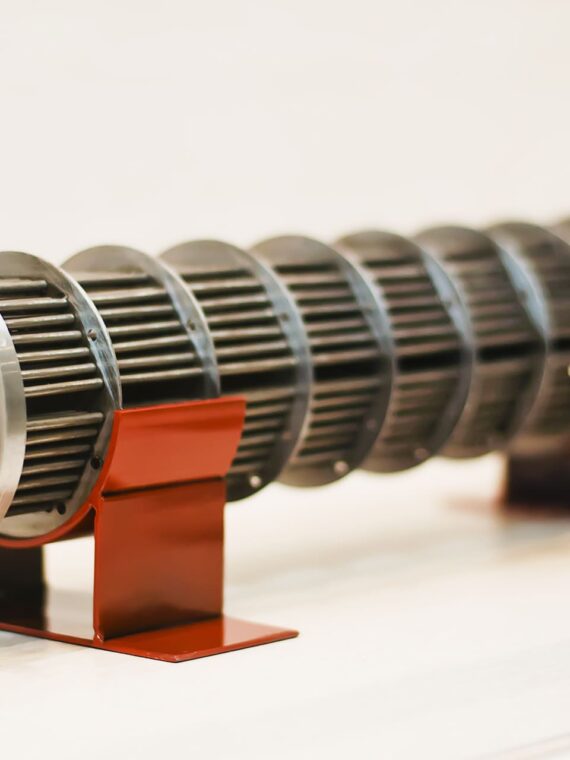

2. On-Going Processing Machines Trend

Most FMCG producers are shifting to continuous processing equipment to meet the increasing volume requirements.

Popular equipment includes:

- Continuous reactors

- Inline homogenizers

- Constant pasteurizers and sterilizers.

The systems provide increased throughput, process control, and reduced operational costs, making them the best fit for large-scale food processing systems in the Netherlands.

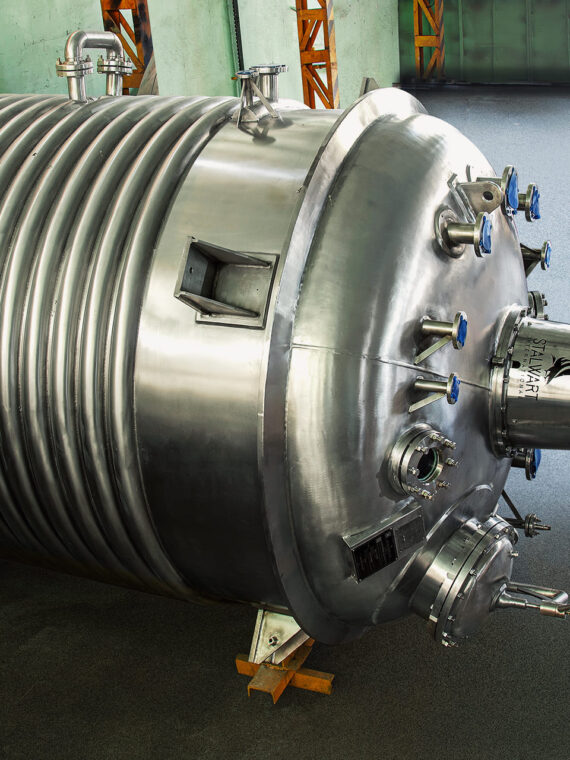

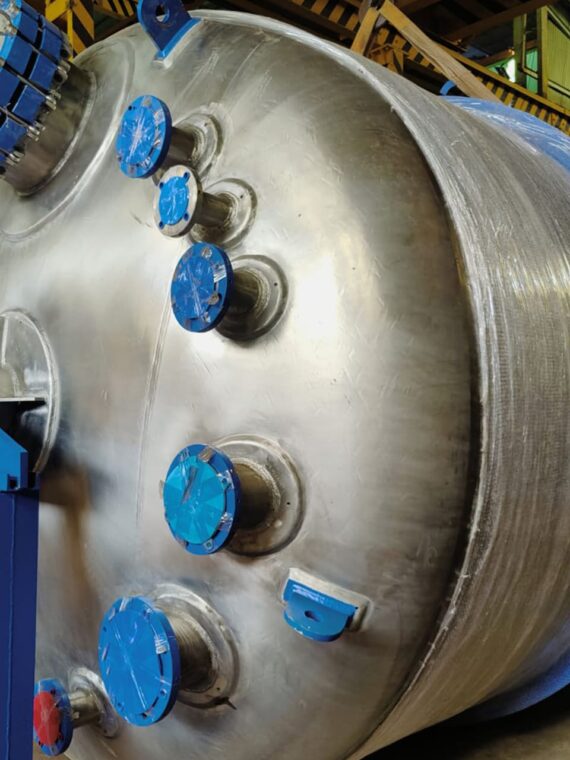

3. Ready-to-Compliance Equipment and Hygienic Design

Europe has some of the strictest food safety legislation in the world. Manufacturers are investing in advanced industrial food processing equipment to comply with HACCP, BRCGS, and EU food safety standards. Key features include:

- Naked stainless steel construction.

- Smooth internal surfaces

- Dead-zone-free piping

- The combined application of CIP (Clean-In-Place) systems.

The hygienic storage tanks, food-grade pumps, pressure vessels, and heat exchangers are equipment that ensures processing is done without contamination and that the audit is approved quickly.

4. Energy-Saving and Environmentally Friendly Equipment

Sustainability is no longer an option in the FMCG industry. Consumers and regulators are demanding lower environmental impact.

As a reaction, food processing equipment in the Netherlands is being developed to encompass:

- Motors and drives that are energy efficient.

- Pasteurizing heat recovery systems.

- Low-water-consuming CIP systems.

- Recycled and bio-based packaging equipment.

The innovations help manufacturers reduce carbon footprints and lower operational costs.

5. Equipment Supporting Plant-Based & Alternative Foods

The Netherlands is a pioneer in plant-based food innovation. This has necessitated the demand for special processing equipment such as:

- High-shear mixers

- Twin-screw extruders

- Texturizers and emulsifiers.

These machines allow manufacturers of FMCG to produce uniform textures and flavors in plant-based dairy, meat substitutes, and functional foods- segments with high growth potential in the whole of Europe.

6. High-tech Automation of Packaging and Finishing

Packaging is a key factor in FMCG branding and shelf appeal. Equipment trends include:

- High-speed regular form-fill-seal machines.

- Multi-format fill and capping lines.

- Labeling and inspection systems are automated.

- Robot depalletizers and palletizers.

State-of-the-art packaging equipment enables SKU flexibility, own-labeling, and export formats, which are essential for Dutch FMCG firms operating in multiple markets worldwide.

Impact on the FMCG Sector

The implementation of modern food processing devices, as applied by the Netherlands manufacturers, is bearing quantifiable fruits:

- Speed: Accelerated production and less changeover time.

- Quality: Tastes good, tastes safe.

- Compliance: Ease of standards in the EU and other parts of the world.

- Scalability: Ability to grow fast without any control.

Innovation in FMCG technology is not a final goal but a competitive niche.

Conclusion

The rapid development of industrial food processing equipment will determine the future of the FMCG industry in the Netherlands. The trend in equipment is transforming how and with what food is produced, packaged, and delivered, with trends including intelligent automation and hygienic design, as well as sustainable and plant-based processing solutions. As consumer demands and regulations rise, FMCG producers in the Netherlands investing in high-tech, multi-purpose, and food-processing machinery that meet these requirements will be at the forefront of the next generation of food production: efficient, sustainable, and internationally competitive.

FAQs

What is the future of the FMCG industry?

The FMCG industry is moving toward automation, data-driven decisions, sustainability, and faster product cycles. Brands that can optimize supply chains, personalize offerings, and reduce costs will survive. Those relying on old distribution models will lose relevance.

What are the future trends in the food industry?

Key trends include plant-based foods, clean-label products, smart packaging, and demand-driven production. Consumers want healthier, transparent, and convenient food options—and they’re willing to switch brands quickly if expectations aren’t met.

What technological trends affect the food industry?

Major technologies shaping the food industry are AI, IoT, robotics, blockchain, and advanced food processing equipment. These improve quality control, traceability, production speed, and cost efficiency. Technology is no longer optional—it’s a competitive advantage.

What is one new way technology is used in the food industry?

One impactful use is AI-based quality inspection, where cameras and algorithms detect defects, contamination, or inconsistencies in real time. This reduces waste, improves safety, and removes human error from critical checks.

What are the latest food technology innovations?

Recent innovations include smart food processing machines, alternative protein technologies, predictive maintenance systems, and digital twins for factories. These innovations focus on efficiency, scalability, and meeting stricter safety and sustainability standards.

Why is the Netherlands important for the FMCG industry in Europe?

The Netherlands is a logistics and trade hub for Europe, with strong ports like Rotterdam and advanced supply chains. Its location, infrastructure, and innovation-friendly policies make it ideal for FMCG manufacturing, processing, and distribution.